How can blockchain projects benefit from deploying their own DEX?

Cryptocurrency exchanges have been instrumental in the adoption of blockchain technology, but the industry has become too dependent on them. Today, the crypto industry is still geared toward exchanges and traders rather than blockchain projects and developers. There is too much friction for developers building projects on the app layer.

Getting listed on a major centralized exchange (CEX) is a six-figure expense, plus additional fees each month for a market maker to ensure liquidity. In 2018, a Business Insider investigation found that crypto exchanges charge between $50,000 and $1 million to list initial coin offerings (ICOs).

Even after those expenses, exchanges are the ones who profit from all the trading fees, which drains value from crypto projects and makes it hard to attract liquidity in a sustainable way.

Besides exorbitant listing fees, DApp builders lose control over the liquidity and value of their Tokens by having to abide by the exchange’s policies and fees. In addition, listing on centralized exchanges can also lead to counterparty risk (not your keys, not your coins).

Regaining control over native tokens

One of the alternative approaches to attract liquidity is to turn to decentralized exchanges (DEXs), which have reduced counterparty risk and low fees due to the absence of intermediaries. This solution may give app builders more control over the liquidity of their tokens, reducing reliance on centralized exchanges and improving security. Moreover, using DEXs rather than CEXs allows blockchain applications to benefit from DEX features, including non-custodial trading, reduced security risks and lack of KYC obligations.

As beneficial as DEXs are, they do have some drawbacks. For example, they are limited by the transaction capacity of their networks. As volume increases, so do the fees for executing trades. This has become a major problem for DEXs, many of which are hosted on Ethereum and use an automated market maker (AMM) to manage their trading. In addition, DEXs aren't efficient enough to compete with CEXs (e.g., in terms of capital efficiency and liquidity levels). Lastly, DEXs prioritize generating revenue for their liquidity providers and token holders, not the projects who use them.

While using a DEX enables self-custody and permissionless settlement, they’re not efficient enough. DEXs still lack support for off-chain pricing models, where pricing is based on the total aggregate liquidity in the market (both on- and off-chain) as opposed to the liquidity that happens to be in a given AMM's smart contracts.

There is a friction point in the user experience as well. Visiting a third-party DEX forces users to leave the apps they love whenever they make a trade.

Shopify for DEXs

The solution might be to make DEXs as efficient as CEXs and give each project ownership of its own DEX. But how to do that? The good news is there are specialized projects that provide such DEX-as-a-feature solutions, and one of them is Native. The project makes it easy for developers to deploy exchanges, integrated directly into their DApps, earning their own swap fees and accessing the liquidity across the network.

Native is a DEX infrastructure layer, or more simply, a toolkit for any other project to become its own DEX, cutting out the middlemen and reducing costs, much like Shopify allowed entrepreneurs to create their own e-commerce sites.

Native’s proprietary integrations with professional liquidity providers and market makers account for over 30% of daily crypto trading volume, giving teams a significant advantage over standalone DEXs. Best of all, it's completely free to use: projects set their own swap fees, which go to token issuers.

The technology behind Native matches CEX-level efficiency and is completely modular, meaning that teams can create any type of exchange they want, using any liquidity sources, pricing models and trading pairs they desire. Projects can work directly with professional liquidity providers and market makers in a permissionless way, on-chain, and get their own liquidity.

Liquidity is king

Liquidity can come from one of three sources: the project itself, the community, or external liquidity sources such as automated market makers (AMMs), aggregators, and professional liquidity providers. Native can leverage a wide range of liquidity resources thanks to its approach of using off-chain pricing and on-chain RFQs (requests for quotes), which lets any project use market makers and professional liquidity providers for on-chain liquidity.

By providing a decentralized infrastructure layer for DEXs, Native is taking a big step toward solving the liquidity and control issues facing blockchain projects. With its innovative approach and focus on empowering crypto entrepreneurs, Native is helping blockchain projects benefit from increased revenue and deeper liquidity. Meanwhile, DApp users can swap the native token directly in the app, enjoying a simpler and more frictionless experience.

Ricky Li from Nomad Capital, which invested $2 million in Native’s seed round, said:

“Native empowers everyone to have their own DEX and control of liquidity and fees. The vision is that no builders or users should be held hostage by CEXs and centralized DEXs like Uni or Curve to facilitate liquidity. This really resonates with our belief that there is a missing financial infrastructure layer that enables us to scale and attract the next users. We need more DeFi middleware infrastructure projects like Native.”

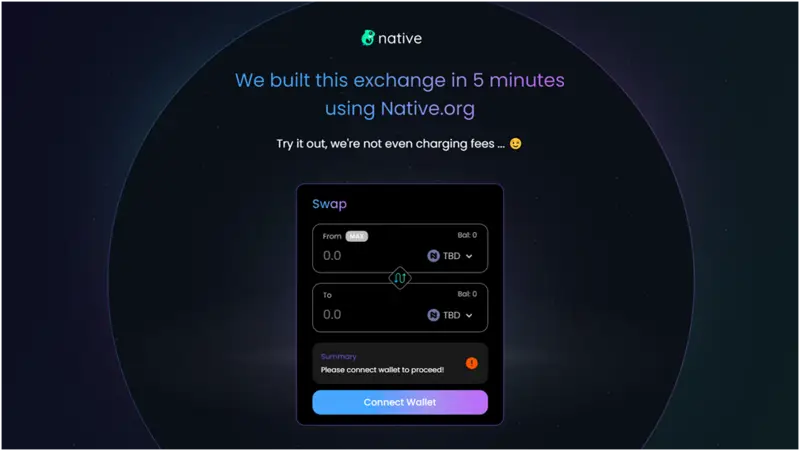

To demonstrate how easy it is to use the technology, Native released 5minuteDEX, a fully-functional DEX with deep liquidity across all the top trading pairs.

Source: 5minuteDEX.com

Native launched its private beta in March of this year and opened up the platform to anyone in April in a permissionless manner.

By providing a DEX layer, Native enables teams to create their own DEXs, reduce costs and regain control over their native tokens. Thanks to this approach, Native has managed to secure strategic partnerships with many blockchain projects, including Ankr, NodeReal, Metaverse.ai, Augmentlabs.io, CyberConnect, QuestN, LightNet and Byte.City.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Comments

Post a Comment