BRICS: US Dollar Reserves Fall 6.5% But Local Currencies Rise 3.65%

The Central Banks of BRICS countries have been offloading US dollars through the year to protect their respective local currencies. BRICS countries such as China, India, and Russia, among others, dumped US dollars to keep their local currencies from falling. The US dollar is slowly finding its way out of Central Banks from around the world, including that of BRICS nations. The year 2023 has relatively been bad for the US dollar as BRICS and other developing countries are looking to uproot it from the world’s reserve currency.

Also Read: BRICS: China Aggressively Dumps US Dollars For 3 Days Straight

BRICS: US Dollar Reserves Dip By 6.5%, Local Currencies Experience a Rise

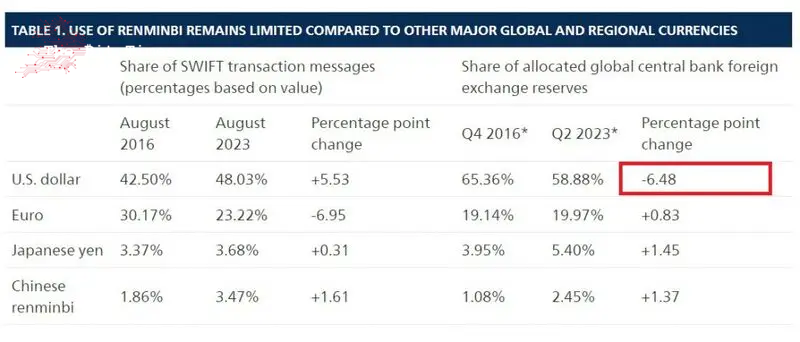

It’s difficult times for the US dollar as Central Banks around the world are cutting ties with the currency. In 2023 alone, the US dollar reserves in various Central Banks fell by 6.48%. However, what comes as a surprise is that local currencies such as the Japanese Yen and the Chinese Yuan increased their share in Central Bank reserves.

Also Read: BRICS: 150 Countries To Pay Chinese Yuan, Not USD for Loan Repayment?

While the US dollar dipped 6.48%, local currencies saw a spike of 3.65% this year in 2023. Recent data shows the Euro rose by 0.83%, the Japanese Yen spiked by 1.45%, and the Chinese Yuan jumped by 1.37%. In conclusion, the development indicates that the US dollar is on a decline, while BRICS currencies are on the rise.

Also Read: US Dollar First Casualty When Trade Between BRICS Countries Rise

Read here to know how many sectors in the US will be affected if BRICS stops using the USD. The move could wreak financial disaster in the homeland and lead to hyperinflation across all sectors in the US.

India aggressively sold US dollars in the foreign exchange markets to strengthen the Rupee in November this year. On the other hand, China halted firms that make bulk purchases in the US dollar and announced a rule that financial institutions can hold foreign currency deposits by a third only.

Comments

Post a Comment