IBIT The Most Profitable BlackRock ETF As The Bitcoin Fund Closes On $100B In Assets

BlackRock’s IBIT is now the asset manager’s most profitable ETF (exchange-traded fund) by a wide margin as the fund nears $100 billion in net assets.

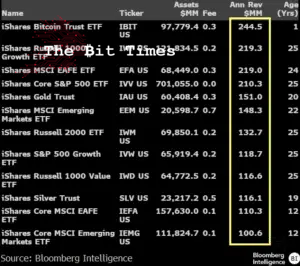

Over the past year, IBIT has generated almost $245 million in fees. This performance beats the iShares Russell 1000 Growth ETF (IWF) and the iShares MSCI EAFE ETF (EFA) by $25 million in annual revenue, according to Bloomberg ETF analyst Eric Balchunas.

Around the middle of July, IBIT was still ranked below IWF and EF in terms of revenue, previous X posts from Balchunas show.

Other Top BlackRock ETFs Took A Decade To Get To Their Current Standing

Blachunas also noted that every other BlackRock ETF in the firm’s top 12 list of funds in terms of fee revenue took approximately more than a decade to get to their current standing.

In his post, Blachunas shared a screenshot of the ages of BlackRock’s top 12 ETFs and their respective annual revenue in dollars. This screenshot shows that other than IBIT, the rest of the top five BlackRock ETFs are all over two decades old.

Top 12 BlackRock ETFs (Source: X)

“Check out the ages of the rest of the Top 10. Absurd,” Balchunas wrote in his post.

IBIT Could Become The Fastest ETF To Hit $100B In Assets

In a comment under his post, Balchunas went on to note that BlackRock’s IBIT is closing in on the $100 billion in asset milestone despite launching less than a year ago. If the current trend continues, his post suggests that IBIT could become the fastest ETF in history to achieve the milestone.

Here’s the fastest ETFs hit to $100b chart. $VOO current best at 2,011 days. $IBIT at 435 days but w $2b to go. Via @JackiWang17 pic.twitter.com/IrGLgrz2dr

— Eric Balchunas (@EricBalchunas) October 6, 2025

The current record holder is the Vanguard S&P 500 ETF (VOO), which achieved the milestone in 2,011 days. Meanwhile, IBIT has only been trading for 435 days and is $2 billion away from reaching the milestone, according to the Bloomberg ETF analyst.

NovaDius Wealth President Nate Geraci also commented on IBIT potentially reaching the $100 billion milestone. To put the spot Bitcoin ETF’s performance into perspective, Geraci said that only 18 of the more than 4,500 ETFs currently in the market have over $100 billion in assets under management (AUM).

Btw…

Only 18 of 4,500+ ETFs have > $100bil AUM.

Read that again.

— Nate Geraci (@NateGeraci) October 6, 2025

US Spot Bitcoin ETFs Extend Inflow Streak, Assets Hit $169B

BlackRock’s strong performance comes as investors continue to flock to US spot Bitcoin ETFs. After notching their second-highest weekly inflows last week of more than $3.3 billion, investors continued to pour capital into the products in the latest trading session.

According to data from SoSoValue, the funds pulled in $1.19 billion on Oct. 6. Much of these inflows were recorded by IBIT, which saw $969.95 million added to its reserves on the day. The next-biggest inflows of $112.32 million were posted by Fidelity’s FBTC.

IBIT has been the dominant US spot Bitcoin ETF since the funds’ inception last year, with its cumulative inflows topping $63 billion. FBTC is next with its cumulative inflows to date standing at $12.73 billion.

Overall, the Bitcoin funds have seen their collective AUM reach $169 billion, according to Bloomberg ETF analyst James Seyffart.

US Spot Bitcoin ETFs now have ~$169 billion in assets…

these charts and about 20 more are available in my chart pack for Bloomberg terminal clients: https://t.co/JxGH5v7Eos pic.twitter.com/uB4Dxyslc7

— James Seyffart (@JSeyff) October 6, 2025

The strong inflows into spot Bitcoin ETFs have helped the crypto market leader achieve back-to-back all-time highs (ATHs). The first record peak above $125k was reached on Oct. 5. Just 24 hours later, BTC then went on to set a new ATH of $126,198.07, CoinMarketCap data shows.

BTC price (Source: CoinMarketCap)

BTC has since retraced to trade at $124,574.69 as of 1:40 a.m. EST.

BlackRock Exploring News Ways To Make Money From Bitcoin

BlackRock is looking to expand on its Bitcoin ETF offering to investors as well, and recently filed to register a Delaware trust company for its proposed Bitcoin Premium Income ETF.

The asset manager’s proposed product would sell covered call options on Bitcoin futures. It will then collect premiums to generate yield.

However, the regular distributions would reduce any potential upside from investing in IBIT.

According to Blachunas, the move indicates that BlackRock chooses to rather expand on its Bitcoin and Ethereum (ETH) offerings and not participate in the altcoin ETF frenzy, at least for now.

Related Articles:

- Michael Saylor Tells MrBeast To Buy Bitcoin Even As He Pauses Strategy Buying

- Bitcoin Price Falls Below $125k ATH As Saylor Pauses BTC Buying

- ASTER Jump 3% On Binance Listing Despite Wash Trading Allegations

Comments

Post a Comment